Read Red

Think it's time for Fed policy that doesn't keep us in the red? Seeing red over what you are fed by the media? Need to be fed with insights with a red (conservative) perspective? Fed up with a government in the red? It's a quadruple entendre, and we're sure you'll find some double entendres within, as well.

Click on the titles below to read the articles of interest to you.

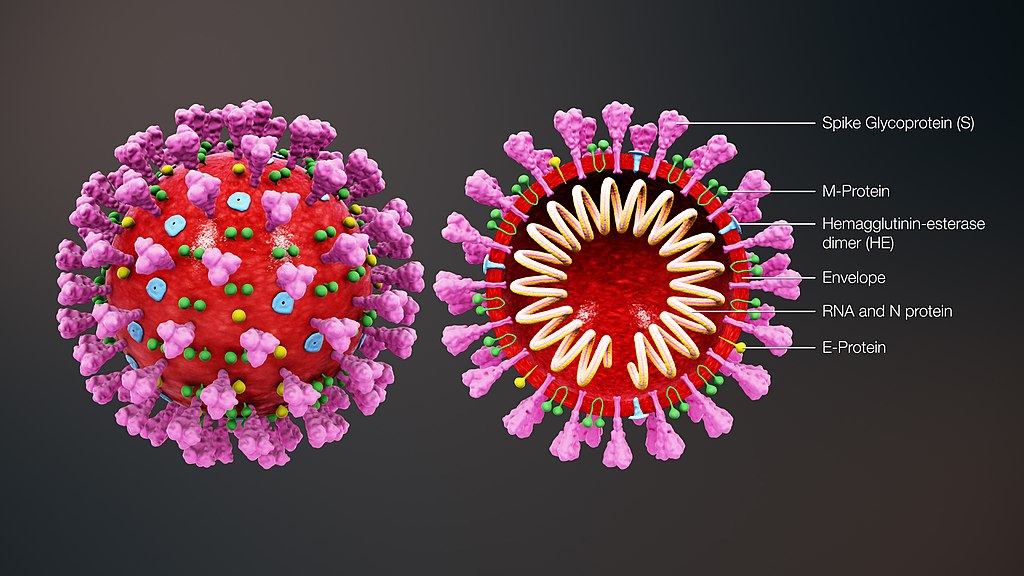

SARS-CoV-2 Lab vs Nature

Ken Witt

Early in the COVID-19 pandemic, there was much speculation that the virus SARS-CoV-2 which causes the COVID-19 illness may have been created in a Chinese government biological lab near Wuhan. Scientific response to the speculation was fairly swift, with the March 11, 2020 publication of a thoughtful analysis of the likelihood of natural origin, based on the genetic code of the virus. Download that paper.

But there are scientific voices in China, particularly Dr Li-Meng Yan, MD, that outline very specific genetic indicators that they hold strongly imply that this virus was lab created. Download that paper. Although Dr Yan has been interviewed on Fox News and other media, Twitter and Facebook have chosen to suppress her articles, which prompted the publication of the paper.

While neither analysis amounts to proof of or against lab creation of the virus, the very specific notes of the latter paper are a strong argument of evidence for a lab source of the virus, rather than a natural occurrence. However, unless evidence of actual clandestine Chinese lab work on the virus emerges, which is highly unlikely, the answer will never be certain.

Ken Witt

Aabren Group

No Profit in Forever: US Postage as an Investment

Ken Witt

I have been fascinated by postage stamps since my early teens. A lifelong philatelist (collector of stamps), I get a lot of questions from friends and family about stamps and stamp collecting. Once in awhile, a theme will emerge, where I hear a question or versions of it from a number of people due to recent events or perhaps just a meme from the current social melee. Such a theme stemmed from the introduction of forever stamps by the United States Postal Service (USPS). These stamps will mail a 1-ounce letter at today’s postal rate and will increase in value to match future postal rates, always matching the cost to mail a 1-ounce letter.

A question has come frequently enough of late that I decided to give it a little research. The question is “Are Forever Stamps an Investment Opportunity?” A variant is “Is US postage a good investment?” In this article, we’ll shed some light on the risks of investing in, essentially, the assumption of rising postal efficiency and a postal proclivity to pass the savings on to the consumer. We’ll complete the investigation with an observation of the perverse incentive that speculation in forever stamps represents.

Unlike most of the philatelic queries posed to me, this question and its variant are not about stamps as collectibles. The question is about postage as a commodity investment. A very different question is whether stamp collectors would find increasing value in some collectible subset of current US forever stamps. The collectible question is not one I am addressing here. The question at hand is about the intrinsic value of US postage stamps which will ultimately be applied as postage for letter delivery.

An appropriate first question is how to define a good investment. Straight profit over time is a poor choice because a profit rate that is less than inflation over the period is not truly a profit. So we will base our assessments of investment quality on relative performance of postage versus the Consumer Price Index for urban communities (CPI-U). CPI information comes from the Bureau of Labor Statistics and the Minneapolis Federal Reserve. Historic postage rates are from the United States Postal Service. A second important question is liquidity of the investment, which we’ll address later.

Let’s start by seeing what an investment in US postage for mailing a 1-ounce first class letter looked like over time. Keep in mind that there were no US forever stamps before April 12, 2007, when the forever Liberty Bell stamp first went on sale. We’ll look at the last 100 years, back to 1920 as a reference point. In the chart below, observe the Consumer Price Index and 1-ounce first class postal rate pegged to 1920, so they both show 100 (100%) at 1920. The chart then shows how each performed over time relative to 1920, which is equivalent to treating 1920 postage as “forever stamps”. You can also see how such 1920 postage stamps performed against the cost of mailing a letter, treating them as they are actually valued for postage today (face value).

Probably the easiest observation in the chart above is that buying postage in 1920 as a cash investment against future postage use (the decreasing line) would have been a losing proposition, as is probably intuitive. It cost two cents to mail a letter in 1920, but that two cent stamp would only provide about four per cent (4%) of the cost to mail a letter today. Since we see almost no declines in postage cost over the last one hundred years, an investment in non-“forever” postage (all postage stamps before 2007) as a long term investment in a commodity (not a collectible) would have been a mistake at every point but one, recently.

We can also easily see in the chart that the unwavering ascent of inflation began in the mid-forties, but went excessively and permanently awry in the late sixties. The postage rates began their crazed ascent just before 1960, with little abatement until the past four years. Despite the inexorable inflation manifested in both quantities, the question of the wisdom of investment in postage requires comparison of the rate of increase of the price index versus the rate of increase of postage, not their individual rates of ascent.

Since we see that hoarding postage stamps before the forever stamps were released was always a bad idea, it is easy to understand why I am able to routinely purchase old US postage at between sixty-five and eighty percent (65% – 80%) of the face value. That means that other parties have held that postage for potentially decades, not only getting no price appreciation but at a huge loss, without even considering inflation. Alas, forever stamps will eventually make this discount postage a thing of the past.

But what about acquiring the more recent forever stamps for future sale as a commodity investment? The chart above shows that postal rate increases have outpaced inflation from 1920. Since these stamps have only become available in the United States in the last eight years, we’ll first consider the question of whether the investment might have been historically a good idea, if stamps were offered as “forever” at the time. We’ll pick as a reference year 1920 and again use the chart above. Look at how investment in forever stamps of 1920 would have performed – they would have been a profit, outperforming the Consumer Price Index at all points after, with the single exception of 1958, which would have been a poor year to sell those 1920 forever stamps.

Significant potential profit from the 1920 or 1958 purchase of fictional forever stamps is an anomaly of the very long period of no postal increases followed by 10 years of little inflation in the first half of the twentieth century, however. Let’s take a look below at a 1980 purchase of fictitious forever stamps.

Postal rates much more closely track inflation in recent decades, leading it a bit. But from 2009 forward, postal rates are again outpacing inflation. So we see that a 1980 purchase of then-fictitious forever stamps would have been a modestly good investment at points just after postal rate increases, ignoring liquidity concerns. This investment would have outpaced inflation better in recent years. One could have enjoyed the same recent profit if the purchase had occurred in 1992, since the postal rate rejoined the inflation line at that point. But do not forget this is a very long term investment, and the return would have been less than 2% per year, ignoring liquidity.

Now we are ready to take a direct look at the very short window thus far (since 2007) of possible profitability in purchasing forever stamps that actually exist. The chart below addresses the question of annual profit potential over the short period. It displays the profit range available within three years of each year forever postage could have been acquired, i.e. 2007 through 2014, since there must be three years after purchase to measure.

The clear revelation above is that the return is about one and a half percent (1.5%) per year. Better than a Certificate of Deposit, but not by much. This is not a good investment, as there are so many places you could idle money to get a better return than this. The top line shows the best possible return if you waited until the end of each multi-year window to sell or sold just before any rate decrease announced. An automated return, the bright green line, shows the profit if you followed a simple course of selling the stamps as soon as there was a rate increase, and the dark red line shows the worst outcome of selling blindly at the end of each year window, even if there was no rate increase or even a decrease.

Simply put, you would have always made a profit within three years of about 1.5% per year, so long as you sold in advance of any announced rate decreases. The picture does not change much for a five-year window, noting that in the past few decades, you can always get two rate changes in a five-year window. The five year upside is better, but the annualized return is about the same.

So returns are very modest, but generally positive, if we assume you can sell for full value whenever desired. But liquidity with full valuation is a problem. Few people would have an incentive to buy postage from a third party (you) for full value when they can conveniently and reliably buy it from the United States Postal Service. To close a sale in any predictable timeframe, you will have to sell the postage at around a ten percent (10%) discount at least. And now your meager positive return is a loss. If you bought forever stamps with the intent to use them in the future, you would have realized about a one and a half percent (1.5%) per annum return on investment. But if you bought them with designs on recovering your money rather than using the postage, you would have lost money.

There is also a perverse incentive for the US Postal Service (USPS) concerning rates and speculation in forever stamps. Since forever stamps rise in monetary value after the payment has been made, the USPS now has an increased incentive to raise postal rates earlier, as they will have to deliver letters for the pre-increase revenue due to the forever stamps already sold but unused. If speculative investment in forever stamps were to occur with any volume, the need to raise rates earlier would rise.

The simple summary: forever postage is a bad commodity investment. Buy forever stamps when you need them for use, or to speculate on collectibles, but not as a hedge against future postage value, so long as postage rates increase modestly ahead of inflation as they have for many years, excepting the years 2015-2017, when they lagged inflation.

Aabren Group

DACA and US Democracy

Ken Witt

The Deferred Action for Childhood Arrivals program (better known as DACA) is a pseudo-executive order issued by President Obama’s administration in June 2012. It allows young undocumented, illegal immigrants to continue to reside in the country to attend school and work without the fear of enforcement of immigration laws pertaining to their resident status. It further allows access to work permits and other government benefits, in violation of law, so it is not merely an exercise of Executive prosecutorial discretion, as it claims.

DACA is pretty clearly unconstitutional, embodying an attempt by a president to impose or override law. Our constitution reserves to the Legislative branch sole law-making ability and to the Executive branch responsibility for enforcing (upholding) the law. The Texas vs United States case, which overturned the similar DAPA executive order, was overturned by the Supreme Court on essentially this argument, and DACA would very likely fail a challenge in court, as well. However, we should not have to sue to undo frequent unconstitutional acts by our President, but rather, we should elect leaders

with the ethics to uphold the constitution, which they swore to do when taking office. In fact, the Constitution explicitly requires that the President “take care that the laws be faithfully executed.”

Whether you think the protections to young illegal immigrants afforded in DACA is a good idea or not, we have in such executive orders a threat to our democracy, or more accurately, a threat to our great Republic, the United States of America. We rely on the rule of law, as we are a nation governed by documented consent of the governed. This consent is codified in the legislation drafted and approved by those we elect to represent us. If these laws can be controverted by the whimsical memoranda of a President or administrators, where law has not given that authority, we have elevated him or her to the office of Dictator. At such a point, our Republic no longer stands, our vote no longer counts, and we will soon find our consent to be governed of no further consequence.

If DACA is a good idea, it must be lawfully and constitutionally codified and approved by Congress to be enacted. No President may write law. President Trump is right to end this executive whimsy, while giving Congress time to implement proper law if DACA is the will of the people they were elected to represent.

1For an accessible discussion of the constitutionality of DACA and executive orders in general, I encourage you to read Stanford Law Professor Michael McConnell’s great Q&A.

Ken Witt

Aabren Group

Ken Witt

Ken Witt